Zayas, LLC, has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 -$78,500 -$78,500 1 $43,000$21,000 2 $29,000$28,000 3 $23,000$34,000 4 $21,000$41,000 What is the IRR for each of these projects? If you apply the IRR decision rule, which project should the company accept?

Joe Jonas and Sophie Turner’s Divorce Timeline | POPSUGAR Celebrity

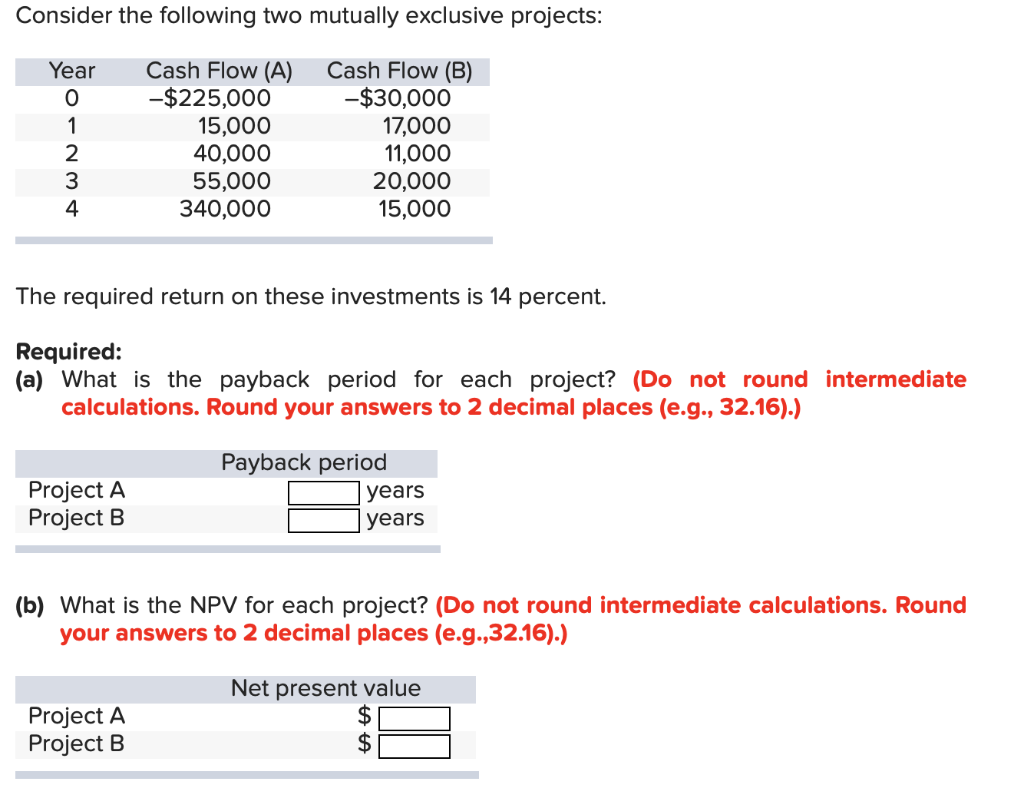

You are considering the two mutually exclusive projects. Both projects have an initial cost of $50,000. Project A produces cash inflows $24,800, $36,200, and $21,000 for years 1 through 3, respectively. Project B produces cash inflows of $41,000, $20,000, and $10,000 for years 1 through 3, respectively.

Source Image: www.e-flux.com

Download Image

Assigment 5 assignment name: consider the following two mutually exclusive projects: yearcash flow cash flow 19,500 14,600 whichever project you. Skip to document. University; High School. Books; Discovery. … Consider the following two mutually exclusive projects: YearCash Flow (A) Cash Flow (B) 0 $ -350,000 $ -50, 1 45,000 24, 2 65,000 22, 3

Source Image: www.coursehero.com

Download Image

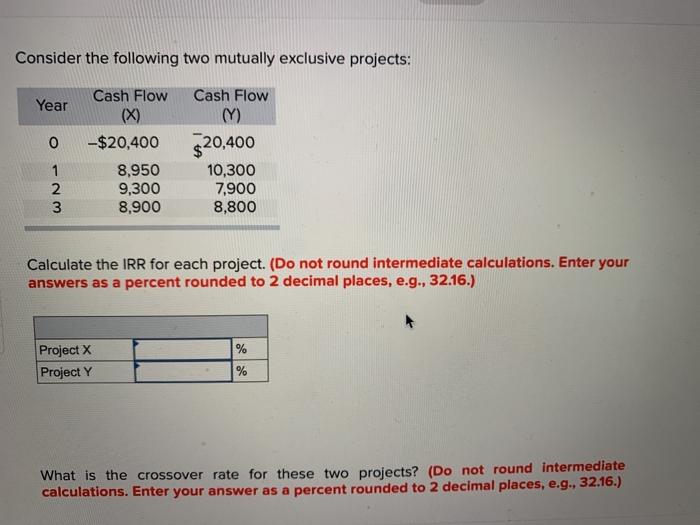

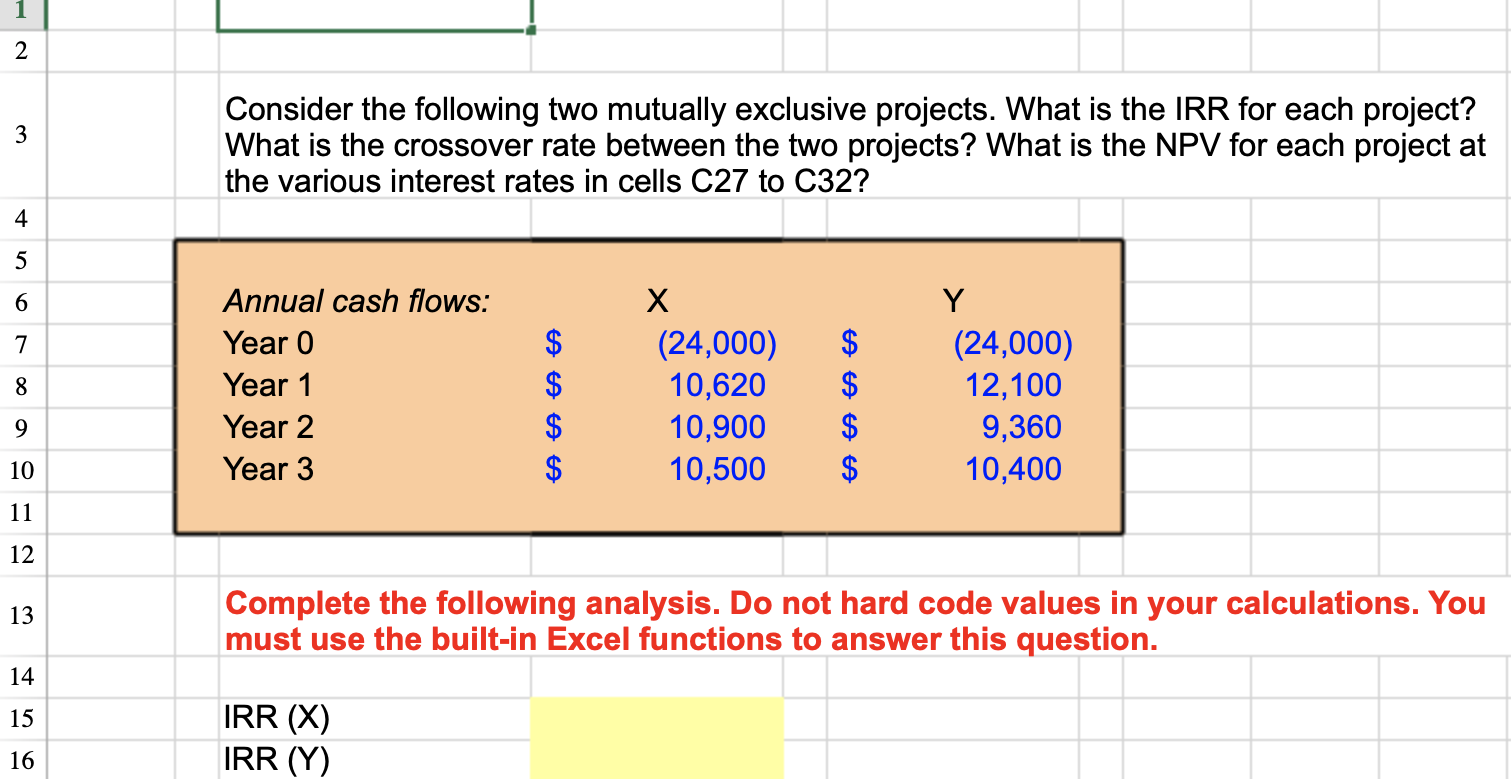

A Comprehensive Guide to the Future of Work in 2030 | On Digital Strategy | Dion Hinchcliffe Feb 17, 2022Consider the following two mutually exclusive projects: Sketch the NPV profiles for X X and Y Y over a range of discount rates from zero to 25 percent. What is the crossover rate for these two projects? Instant Solution: EXPERT VERIFIED Step 1/3 Step 1: Calculate the NPV for each project at different discount rates.

Source Image: www.chegg.com

Download Image

Consider The Following Two Mutually Exclusive Projects:

Feb 17, 2022Consider the following two mutually exclusive projects: Sketch the NPV profiles for X X and Y Y over a range of discount rates from zero to 25 percent. What is the crossover rate for these two projects? Instant Solution: EXPERT VERIFIED Step 1/3 Step 1: Calculate the NPV for each project at different discount rates. Problem 1 In order to determine which among the mutually exclusive projects to choose, we must use the NPV method. The NPV of the each project is computed with the highest NPV being the most preferable. The formula to compute NPV is NPV= Total discounted PV of cash flows – Initial Investment Step1 : Compute for the discounted value of cash flows

Solved Consider the following two mutually exclusive | Chegg.com

Mutually Exclusive Projects is the term which is used generally in the capital budgeting process where the companies choose a single project on the basis of certain parameters out of the set of the projects where acceptance of one project will lead to rejection of the other projects. Solved Consider the following two mutually exclusive | Chegg.com

Source Image: www.chegg.com

Download Image

Strategic Alliances – Partnering for Mutual Benefit Mutually Exclusive Projects is the term which is used generally in the capital budgeting process where the companies choose a single project on the basis of certain parameters out of the set of the projects where acceptance of one project will lead to rejection of the other projects.

Source Image: www.mindtools.com

Download Image

Joe Jonas and Sophie Turner’s Divorce Timeline | POPSUGAR Celebrity Zayas, LLC, has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 -$78,500 -$78,500 1 $43,000$21,000 2 $29,000$28,000 3 $23,000$34,000 4 $21,000$41,000 What is the IRR for each of these projects? If you apply the IRR decision rule, which project should the company accept?

:quality(85):upscale()/2023/09/21/763/n/1922398/51687bb5650c7b29dab8e2.53946894_.jpg)

Source Image: www.popsugar.com

Download Image

A Comprehensive Guide to the Future of Work in 2030 | On Digital Strategy | Dion Hinchcliffe Assigment 5 assignment name: consider the following two mutually exclusive projects: yearcash flow cash flow 19,500 14,600 whichever project you. Skip to document. University; High School. Books; Discovery. … Consider the following two mutually exclusive projects: YearCash Flow (A) Cash Flow (B) 0 $ -350,000 $ -50, 1 45,000 24, 2 65,000 22, 3

Source Image: dionhinchcliffe.com

Download Image

Solved 1 2 3 Consider the following two mutually exclusive | Chegg.com Stepby-step explanation. Step 1 – Determine what metric should we use to decide. We are going to use the Net Present Value Metric. Step 2 – What is the Net Present Value Criteria. NPV, or net present value, is how much an investment is worth throughout its lifetime, discounted to today’s value. The formula for NPV is often used in investment

Source Image: www.chegg.com

Download Image

Solved Consider the following two mutually exclusive | Chegg.com Feb 17, 2022Consider the following two mutually exclusive projects: Sketch the NPV profiles for X X and Y Y over a range of discount rates from zero to 25 percent. What is the crossover rate for these two projects? Instant Solution: EXPERT VERIFIED Step 1/3 Step 1: Calculate the NPV for each project at different discount rates.

Source Image: www.chegg.com

Download Image

Consider the following two mutually exclusive projects: |Year | Cash Flow (A) |Cash Flow (B) |0 |$ 342,000 | $ 50,500 |1 |53,000 | 24,800 |2 | 73,000 | 22,800 |3 |73,000 |20,300 |4 | 448,000 |15,400 Whichever project you choose, if any, you requir … Problem 1 In order to determine which among the mutually exclusive projects to choose, we must use the NPV method. The NPV of the each project is computed with the highest NPV being the most preferable. The formula to compute NPV is NPV= Total discounted PV of cash flows – Initial Investment Step1 : Compute for the discounted value of cash flows

Source Image: homework.study.com

Download Image

Strategic Alliances – Partnering for Mutual Benefit

Consider the following two mutually exclusive projects: |Year | Cash Flow (A) |Cash Flow (B) |0 |$ 342,000 | $ 50,500 |1 |53,000 | 24,800 |2 | 73,000 | 22,800 |3 |73,000 |20,300 |4 | 448,000 |15,400 Whichever project you choose, if any, you requir … You are considering the two mutually exclusive projects. Both projects have an initial cost of $50,000. Project A produces cash inflows $24,800, $36,200, and $21,000 for years 1 through 3, respectively. Project B produces cash inflows of $41,000, $20,000, and $10,000 for years 1 through 3, respectively.

A Comprehensive Guide to the Future of Work in 2030 | On Digital Strategy | Dion Hinchcliffe Solved Consider the following two mutually exclusive | Chegg.com Stepby-step explanation. Step 1 – Determine what metric should we use to decide. We are going to use the Net Present Value Metric. Step 2 – What is the Net Present Value Criteria. NPV, or net present value, is how much an investment is worth throughout its lifetime, discounted to today’s value. The formula for NPV is often used in investment